China’s Influence on Global Gold Prices

China, one of the founding members of BRICS, is currently playing a significant role in driving up global gold prices. As the US dollar depreciates, the importance of alternative reserve currencies is becoming more prominent. This shift has led to a surge in the price of gold, reaching record highs of 2,342.43. Economists point to the People’s Bank of China as a key player actively investing in this precious metal.

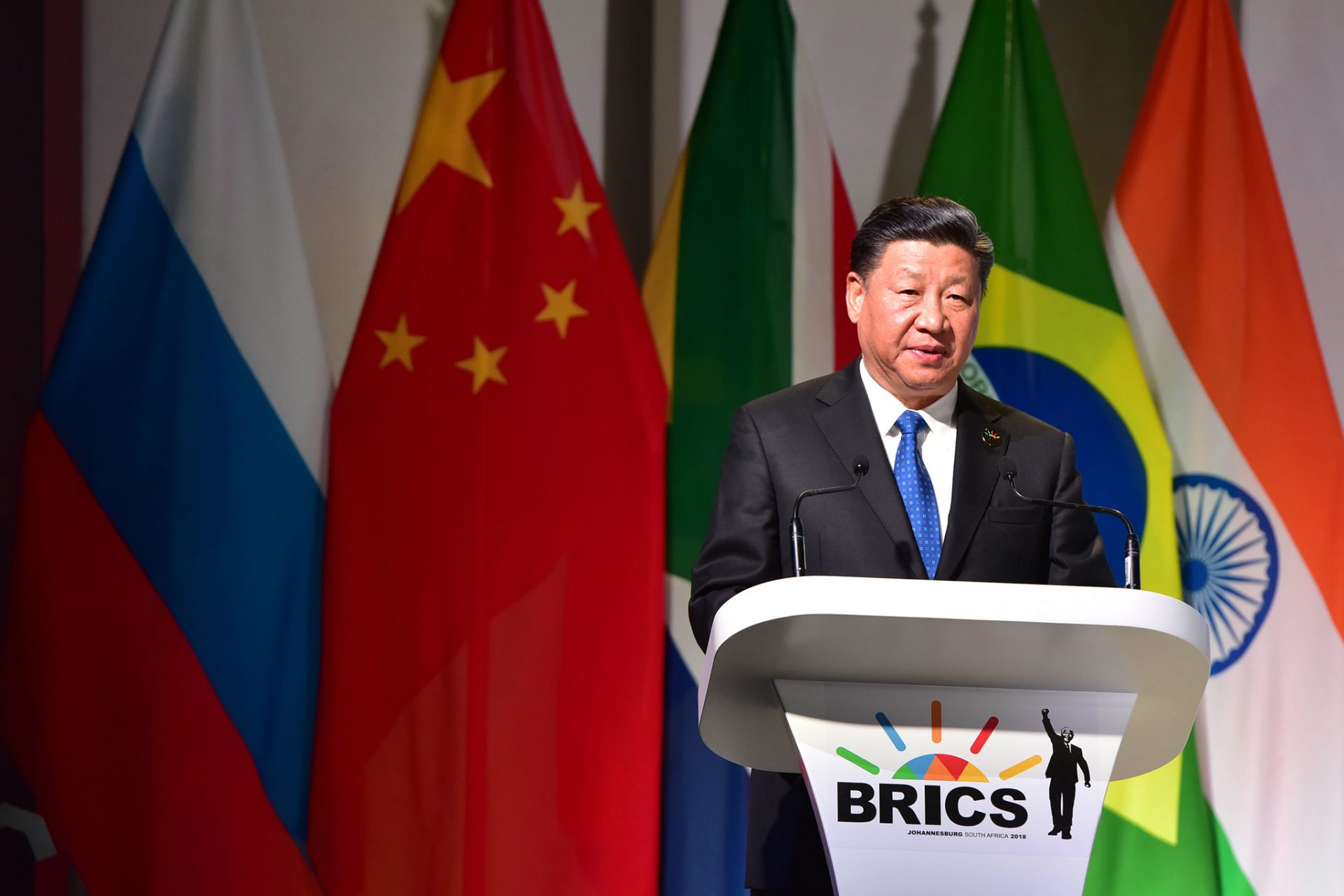

Gold’s appeal lies in its liquidity, return characteristics, and resilience during significant events or economic downturns. It serves as a viable alternative to the US dollar, a fact that China is leveraging. The BRICS alliance is actively engaged in de-dollarization efforts, aiming to reduce dependence on the US dollar as the primary global reserve currency. This initiative has garnered support from various countries and gained traction due to current economic circumstances.

Chinese Investment Strategies

In recent months, China has been aggressively increasing its investment in gold. The People’s Bank of China reported a continued rise in its gold reserves for the 16th consecutive month in February, based on data from the World Gold Council. Central banks in emerging markets are also boosting their gold holdings, with China positioning itself as a key player in the global gold trade.

BRICS and Gold-Backed Currency

Rumors suggest that the under-development BRICS currency could be backed by gold, adding to the momentum behind China and other member countries’ interest in this precious metal. As gold continues its bullish trend, countries like China are capitalizing on the potential for further growth in the asset’s value.

Also Read: BRICS: Chinese Yuan Officially Overtakes US Dollar

Insight:

China’s active pursuit of gold as a strategic investment aligns with its broader economic and geopolitical objectives. By increasing its gold reserves and potentially backing the BRICS currency with gold, China seeks to diversify its holdings and reduce reliance on the US dollar. Additionally, China’s focus on gold underscores its push for financial independence and its growing influence in shaping global economic trends.