India’s Multi Commodity Exchange (MCX) reported an increase in gold prices on Tuesday. The price for 10 grams of gold rose to 62,324 Indian Rupees (INR), up 181 INR from the previous day. Additionally, gold futures contracts also saw an increase to 62,124 INR per 10 grams from 62,010 INR. Conversely, the price for silver futures contracts decreased to 71,090 INR per kg from 71,638 INR per kg.

Moreover, a major Indian cities table demonstrated varying gold prices across different regions in India. The price of gold in Ahmedabad stood at 64,435 INR, while in Mumbai it was 64,245 INR. New Delhi, Chennai, and Kolkata also had different gold prices at 64,320 INR, 64,430 INR, and 64,445 INR, respectively.

Looking at global market movers, geopolitical tensions and a softer US Dollar contributed to the rise of Comex Gold prices. Conflicts in the Middle East, economic difficulties in China, and other global events have impacted gold prices. Investors are also adjusting their expectations for policy easing by the Federal Reserve, contributing to the fluctuations in the market.

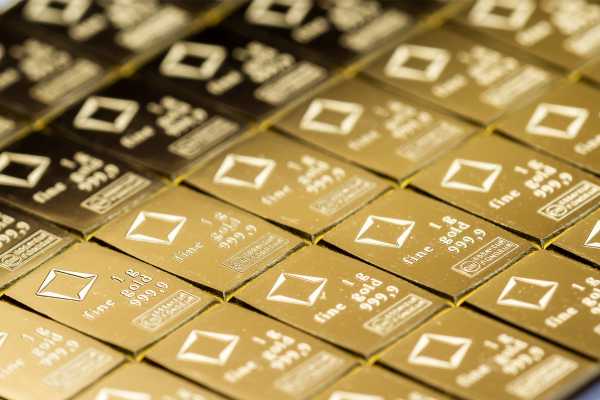

Gold has historical significance and plays a vital role as a safe-haven asset, especially during turbulent times. Central banks are among the major holders of gold due to its ability to improve the perceived strength of economies and currencies. The precious metal also has an inverse correlation with the US Dollar and US Treasuries, making it an attractive asset for diversification during uncertain times.

Overall, gold prices are influenced by a variety of factors, including geopolitical instability, economic conditions, interest rates, and the strength of the US Dollar. These elements contribute to the movement of gold prices in the market.