Federal Reserve’s Policy Outlook

Jerome Powell, Chair of the Federal Reserve, hinted at potential rate cuts in the future, but the timing remains uncertain. He stressed a cautious approach, aiming for sustainable inflation movement towards the 2% target.

Treasury Yields and Dollar Performance

Last week saw significant movements in Treasury yields and the U.S. Dollar. The 10-year Treasury note dropped by 2.51%, closing at 4.079%, while the U.S. Dollar Index (DXY) fell to 102.741, down by 1.10%. These shifts have increased gold’s attractiveness as an investment option.

Labor Market Data’s Influence

Friday’s U.S. labor market data revealed a rise in unemployment and moderated wage gains, despite robust job growth, reinforcing expectations of a Fed rate cut around June. This positive outlook has boosted the gold market, suggesting potential for further price growth.

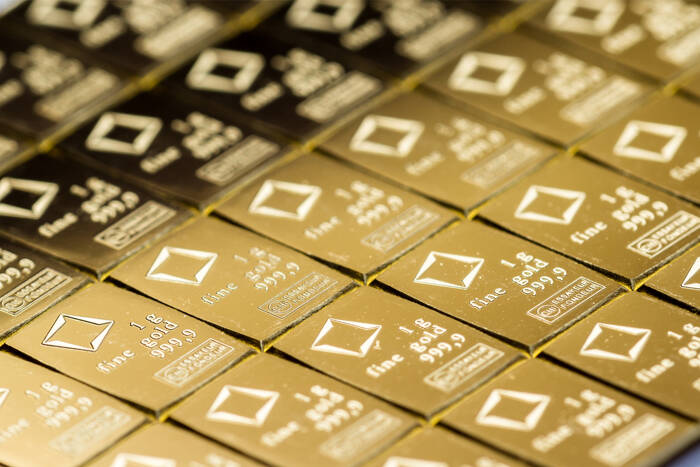

Central Bank Gold Purchases

Central banks, especially in emerging markets, are steadily accumulating gold to diversify reserves and reduce dependence on the U.S. Dollar. This trend has contributed to the high prices of gold in the market.

Impact of CPI and PPI Reports

The upcoming Consumer Price Index (CPI) and Producer Price Index (PPI) reports could have a significant impact on gold prices. Higher-than-expected inflation readings may lead the Fed to hold off on rate cuts, potentially causing a consolidation in gold prices as investors reassess the situation. Conversely, lower-than-anticipated inflation figures could reinforce expectations of rate cuts, bolstering gold’s position as a safe-haven asset.

Short-Term Market Forecast

Given these factors, the short-term forecast for gold appears bullish. The expectations of Federal Reserve policy, weakened U.S. Dollar, declining Treasury yields, and continued central bank demand all point towards a positive trend in gold prices. However, it is important for investors to closely follow the CPI and PPI reports, as they could sway market sentiment and Fed policy, impacting gold prices in the immediate future.

Additional Insight: One key factor to consider in the gold market is geopolitical tensions and economic uncertainty. Any escalation in global conflicts or economic instability could lead to an increase in demand for gold as a safe-haven asset, further driving up prices. Keeping an eye on these external factors can provide valuable insights into the future movements of the gold market.