Gold prices have reached a new record high, surpassing 2400.00 USD, as investors flock to the precious metal for its safe-haven appeal amidst escalating geopolitical tensions and uncertain economic conditions.

Geopolitical Tensions and Market Demand

The recent surge in gold prices can be attributed to the heightened geopolitical tensions, particularly in the Middle East. Despite the Federal Reserve’s inclination towards gradual interest rate cuts, ongoing conflicts, especially with Iran’s involvement, have raised concerns about the region’s stability. This uncertainty has bolstered gold’s status as a defensive asset, with the potential for further price increases if the conflict persists.

Investors are turning to gold as a safe investment option, overshadowing other economic indicators such as currency fluctuations, as they seek to protect their portfolios in times of turmoil. As long as the geopolitical situation remains volatile, interest in gold is expected to remain strong.

Technical Analysis of XAU/USD

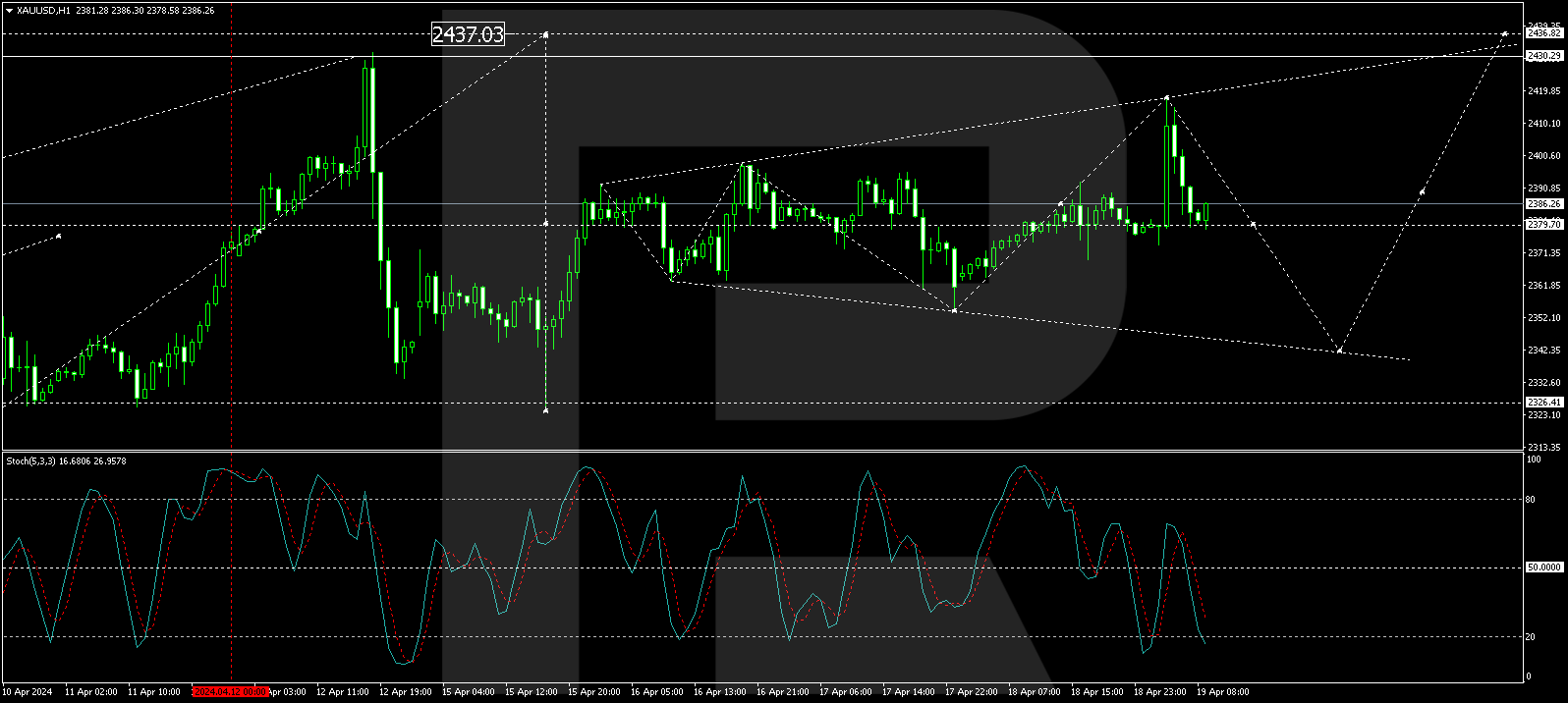

Looking at the H4 chart of XAU/USD, a consolidation range has formed around 2379.70. A breakout above this range could lead to a target of 2437.00, followed by a potential correction towards 2323.23 and 2183.42. The MACD indicator suggests a possible downward trend in the signal line, supporting this scenario.

On the H1 chart, XAU/USD displays a “Triangle” formation around 2379.70. A downward movement to 2342.42 may be followed by an upward trajectory towards 2437.00, with a subsequent decline to 2323.23. The Stochastic oscillator indicates a potential upward movement within this framework, with the signal line expected to rise towards 80.

Insight: The ongoing geopolitical tensions and uncertainties surrounding the global economy continue to drive investors towards safe-haven assets like gold. The evolving situation in the Middle East, especially with Iran’s involvement, underscores the importance of gold as a reliable store of value during times of turmoil. Technical analysis provides valuable insights into possible price movements for XAU/USD, aiding investors in making informed decisions based on market trends and indicators.