- Acceptance below $2300/oz remains elusive as bulls return in force.

- PCE inflation data could shake up the markets and provide a stable medium-term outlook for gold prices.

- Trendline break hints at potential upside toward $2365-2370/oz area.

Must Read: US Dollar on Edge: how PCE data could shake up the markets

Gold (XAU/USD) prices surged on Thursday following a sharp selloff and a brief dip below the $2300 psychological barrier. As highlighted in yesterday’s article, staying below this level remains challenging, making the current rebound strong.

Today’s US data presented a mixed picture again: an uptick in initial jobless claims was balanced by an upwardly revised GDP print that met expectations. This adds to the confusion as market participants search for decisive data to establish a reliable timetable for rate cuts. The prolongation of this uncertainty suggests more erratic and abrupt short-term market movements.

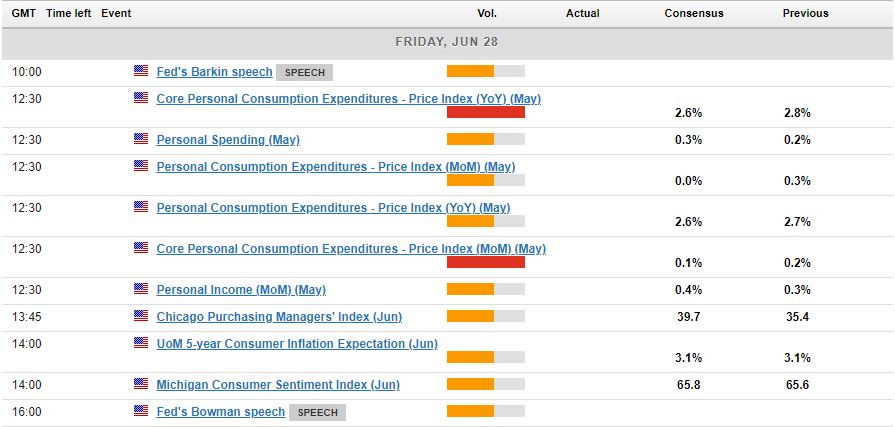

Hence the growing anticipation in the lead up to tomorrow’s PCE release and the end of the quarter. Quarterly flows, repositioning, and re-balancing tend to stoke some form of market volatility and should not be ruled out.

US Interest Rate Probabilities, June 27, 2024

Source: LSEG (click to enlarge)

Looking at the interest rate probabilities for the Fed and markets are pricing in a rate cut in September at around 65.8%. This is slightly off from what Fed policymaker Rafael Bostic expects. Bostic, who is President of the Atlanta Federal Reserve said he expects a rate cut in Q4 as he would prefer to be certain that inflation will return to 2% before an initial cut.

The Look Ahead

US data aside, this evening is shaping up to be massive for the United States as we have the Presidential debate between US President Joe Biden and former President Donald Trump. Keep an eye on any significant move in the US Dollar which could impact gold prices. I do however expect any volatility or moves after the debate to be short lived and to serve more as a guide of what to expect in November.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar.

Technical Analysis

Gold (XAU/USD)

Gold has broken the descending trendline on the H2 chart and came within a whisker of the first price target (based on trading trendline breaks) around 2334. Resistance that is holding the rally back is being provided by the 100 and 200-day MA resting around the 2326 mark. A break above both these levels brings the 2350 and 2370 handles into sharp focus.

Alternatively, a rejection from the MAs could lead to a retracement back toward the $2300/oz mark ahead of the data releases tomorrow.

At present, Gold needs to either find acceptance above the $2400/oz or below the $2300/oz mark in order for continuation to take place. When this finally does come to fruition, we may see the return of longer-term trends from gold, something which has been missing for a good few months.

Gold H2 Chart, June 27, 2024

Source: TradingView.com (click to enlarge)

Key Levels to Keep an Eye on;

Support

The key support level to monitor is around the $2300/oz mark, as a breach below this could signal further downside momentum for Gold.

Resistance

On the resistance side, watch for potential hurdles at the $2350 and $2370 levels, where a breakout could indicate a bullish trend continuation.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award-winning forex, commodities, and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

### Additional Insight:

#### Influence of Presidential Debate

The upcoming Presidential debate between US President Joe Biden and former President Donald Trump could introduce short-term volatility in the US Dollar, potentially impacting gold prices. Investors should closely monitor any significant market movements following the debate, which might offer insights into how markets could behave leading up to the November elections.

#### Rate Cut Expectations

While markets are currently pricing in a rate cut in September, there is discrepancy in expectations among Fed policymakers. It is essential to consider the viewpoints of key figures like Rafael Bostic, President of the Atlanta Federal Reserve, who anticipates a rate cut in Q4 pending confirmation of inflation returning to 2%. Such divergent outlooks could add to the uncertainty in the market.

#### Market Reactivity to PCE Data

With the release of PCE data on the horizon, investors should prepare for potential market fluctuations. Any surprises in the data could reshape medium-term outlooks for gold prices and influence trading sentiment. Traders should remain vigilant and adapt their strategies accordingly to navigate through the market uncertainties.