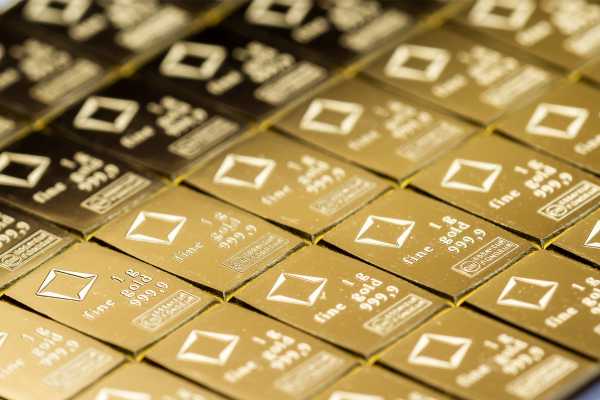

Gold prices, represented by XAU/USD, are on the rebound after experiencing significant declines earlier in the week, pushing the value of bullion to multi-week lows. Currently, gold is trading near $2,021, reflecting a 1.92% decrease in the last 24 hours.

Despite this recovery, the stabilization of the U.S. dollar is limiting the potential for substantial gains in the gold market. The dollar index is hovering just above 103.40 against a basket of currencies, while the continuous increase in U.S. Treasury yields is reducing the appeal of non-yielding gold to investors.

The optimism surrounding the U.S. economy, fueled by stronger-than-expected economic releases on Thursday, has further dampened the outlook for gold. The outperformance of jobless claims and a regional Fed manufacturing gauge has signaled resilient economic momentum, despite ongoing rate hikes aimed at slowing growth.

As the week comes to a close, the likelihood of a rate decrease by March is still decently perceived in the market. However, gold bulls are growing skeptical as terminal rate expectations increase. With no indication of a Federal Reserve pivot in sight, gold may face additional selling pressure, particularly after dropping below the $2,050 support earlier in the week.

Analysts anticipate gold to stabilize around current levels in the near term, but a bearish bias remains dominant due to rising yields, dollar strength, and persistent inflation, which are expected to keep the Fed in tightening mode for an extended period.

According to CoinPriceForecast analysis, gold’s price could reach a range of $2025–$2026 this weekend. However, the sentiment suggests that gold is unlikely to find strong support heading into the weekend.

Insight: Along with the factors mentioned in the original article, the geopolitical tensions, especially those involving Russia and Ukraine, could influence the demand for gold as a safe-haven asset. Additionally, geopolitical events can lead to market uncertainty and potentially increase the appeal of gold as an investment. Amidst the ongoing shifts in the global economy, monitoring geopolitical developments could provide valuable insight into the future movement of gold prices.