In times of bullish markets, riskier assets tend to perform well, a trend often referred to as “risk-on mode.” This includes gold, which typically sees Silver outperforming or at least moving in a similar trend when its price is rising.

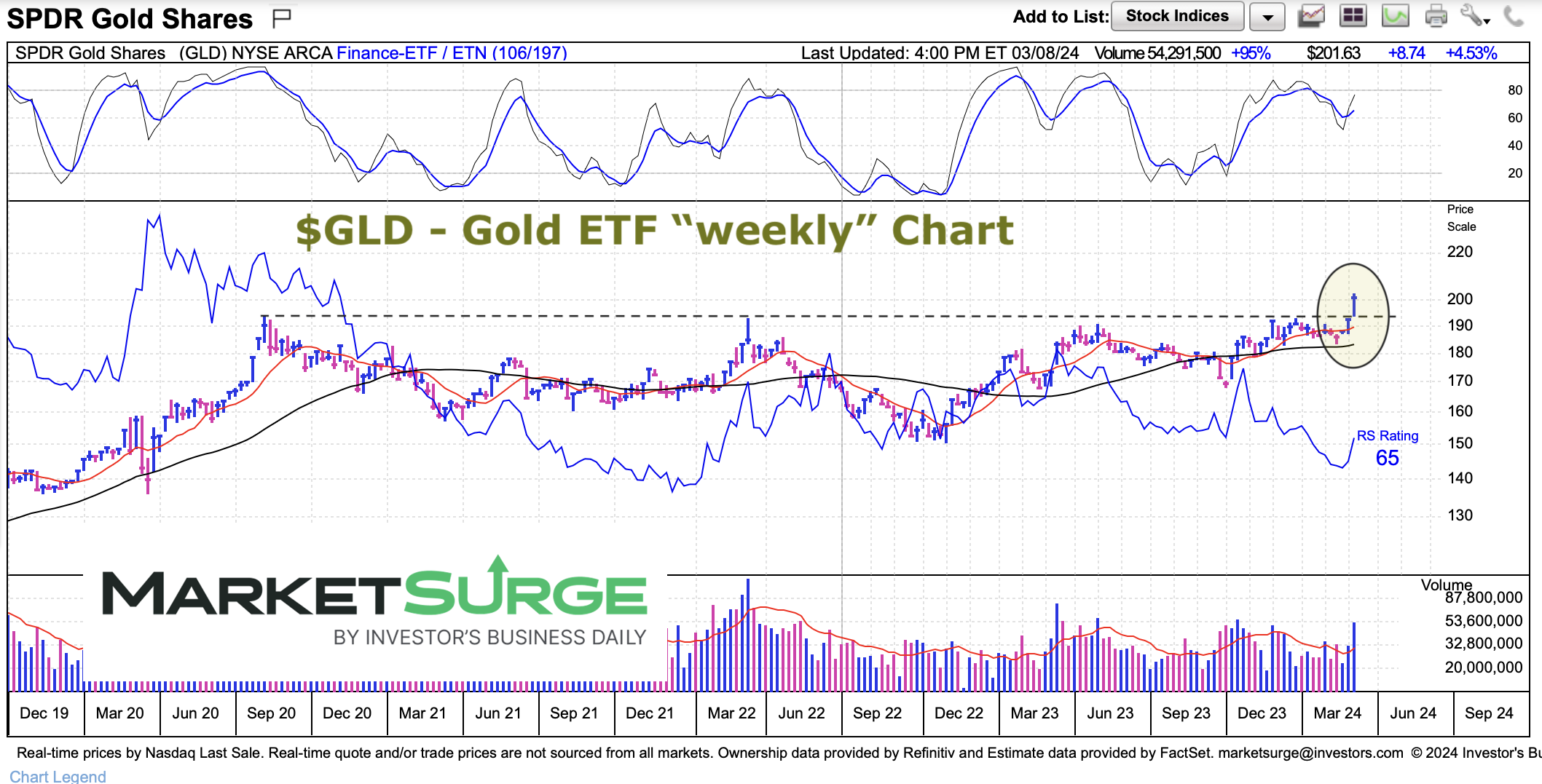

Last week, Gold broke out significantly, reaching all-time highs with a nearly 5 percent surge. Silver also showed strong performance, although it has not broken out yet. For Gold to maintain its strength, it is crucial for Silver to catch up and eventually break out, reinforcing the bullish trend.

The charts provided by MarketSurge showcase the breakout in Gold and the lagging performance of Silver. While Gold is showing signs of bullish momentum with new highs, Silver is yet to reach that level. For the rally to sustain long-term, it is essential for Silver to start outperforming.

Additional insight:

– The relationship between Gold and Silver prices can be crucial for investors as they often act as leading indicators for each other in the precious metals market.

– The performance of Silver relative to Gold can provide insights into market sentiment towards economic conditions, inflation, and overall risk appetite.

– Monitoring the interplay between Gold and Silver prices can help investors make informed decisions in allocating their assets within the metals sector.