The Theory Of Money Supply And Asset Valuation

Timmer’s analysis delves into the concept of “fiscal dominance,” where government intervention leads to an expansion of the money supply, posing a threat to the currency’s purchasing power. By examining historical data on M2 money supply/CPI relationship, Timmer asserts the imminent inflationary pressures in the economy.

While Bitcoin and gold are perceived as assets resistant to inflation, Timmer believes a full transition to such an inflationary environment is yet to transpire, even post the Federal Reserve’s hawkish approach.

Additionally, Bitcoin’s volatility has earned it monikers like “digital gold,” “gold 2.0,” and “exponential gold” due to its incorporation of monetary characteristics akin to gold and its status as a novel internet technology.

For Bitcoin to rival gold’s status as a store of value, fiat monetary aggregates must continue to show excessive growth beyond typical patterns.

While the M2 money supply saw a surge during the recent pandemic, the Fed’s contractionary monetary policy swiftly curtailed the growth, signaling that both gold and Bitcoin might currently be premature in their roles as absolute stores of value.

Moreover, the recent CPI report hinting at a slowdown in inflation has propelled Bitcoin’s price to $69,523, bolstering its position as a store of value.

The positive impact of the CPI report is mirrored in gold’s price, which witnessed a 0.91% surge over the past 24 hours, with a current trading price of $2,336.

Effects of Treasury Yield Correlations on Bitcoin

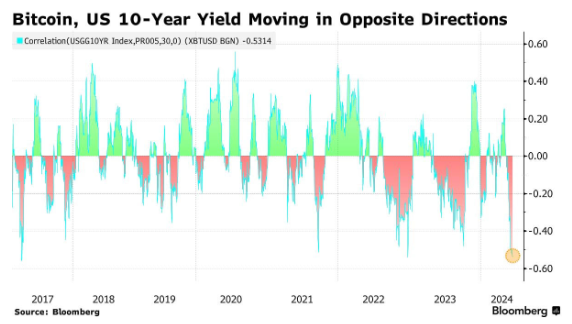

According to recent data by Barchart, Bitcoin price has severed its correlation with the 10-year U.S. Treasury bond yield, marking the lowest level of correlation in the past 14 years at -53.

This disconnect signifies that Bitcoin is progressively evolving without being swayed by traditional fiscal instruments like the yield on U.S. Treasury bonds. This divergence signals a potential shift of Bitcoin towards being a distinct asset class.

If Bitcoin continues to distance itself from conventional financial metrics, it could reinforce its position as a superior non-traditional hedge against fiscal uncertainties.

However, Timmer cautions that the effectiveness of Bitcoin and gold as stores of value is contingent on economic scenarios yet to unfold, especially in the realm of money supply and inflation.

Featured image created with DALL-E, Chart from TradingView

Having Bitcoin and gold as potential hedges against inflation and economic uncertainties in different scenarios can diversify an investment portfolio for risk management. Investors may consider monitoring the evolving relationship between these assets and traditional financial instruments to make informed decisions regarding their asset allocations.