Gold has long been considered a safe-haven asset, especially during times of economic and geopolitical volatility. With today’s price hitting £1,602.79 per ounce, it’s worth noting that the value has remained unchanged from yesterday’s closing price (£1,592.89). However, compared to last week, the price of gold has dropped by 0.27%, and it’s up 0.92% from a month ago. It’s important to consider that the price of gold can be extremely volatile, making it an inherently risky investment.

Investors often turn to gold to hedge against risk or to diversify their investment portfolio. Gold may also provide a way of preserving wealth in a high inflation environment. While studies have found that gold can be an effective way to defend wealth against inflation over extremely long periods, in the short-term, the inflation-adjusted price of gold fluctuates dramatically. Furthermore, investing in gold in its physical form does not produce income or yield and may require additional costs associated with secure storage.

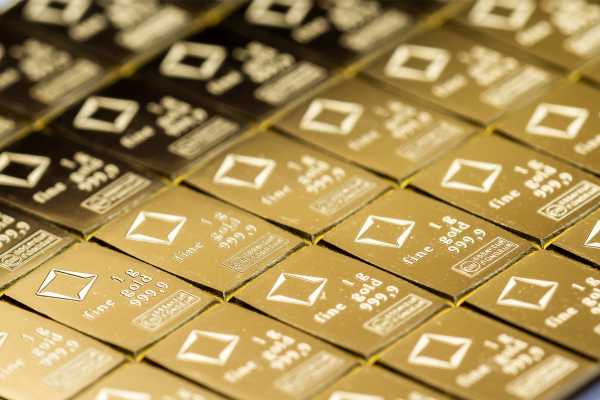

There are several ways to invest in gold. One can buy gold in physical form, such as gold bars, gold coins, or gold jewelry, all of which have their pros and cons. Alternatively, investors can indirectly invest in gold through gold shares or gold funds. Digital gold is also an option, allowing investors to buy fractions of physical gold stored by the seller.

It’s important to consider the current economic and political climate when deciding whether to buy gold. Gold prices are highly sensitive to changes in demand and can be influenced by factors such as currency movements and inflation. While there are potential benefits to investing in physical gold, it’s critical for investors to carefully weigh these factors and consider their long-term investment strategy before making a decision.