Investors continue to speculate about a potential rate cut by the Federal Reserve, causing the US Dollar to weaken. This has led to bullish momentum for XAU/USD, which is currently trading around $2,030. The Fed’s recent warnings against betting on a rate cut have not deterred market players, with the odds for a rate cut in March decreasing to 34.4% and increasing to 55.1% for June.

In addition to the weakened US Dollar, Wall Street is also trading in the red, although earnings reports are helping to offset some of the losses. Furthermore, government bond yields have recovered ground, contributing to the overall weakness in the US Dollar.

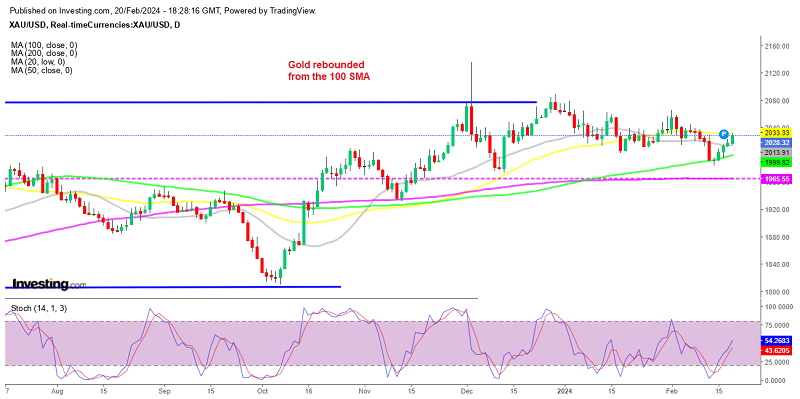

From a technical standpoint, the daily chart for XAU/USD indicates increased bullish potential, with the bright metal trading above its 20 Simple Moving Average (SMA). The longer moving averages are also gaining upward traction, with the 100 SMA providing dynamic support at around $1,995.35. The Momentum indicator remains directionless, but the Relative Strength Index (RSI) indicator maintains its bullish slope, skewing the risk to the upside.

In the near term, XAU/USD has lost momentum but still holds onto gains, limiting the risk of a steeper slide. The 20 SMA on the 4-hour chart reflects ongoing momentum, while the longer moving averages remain directionless. Technical indicators suggest an ongoing retracement rather than an upcoming leg south.

Support levels for XAU/USD are at $2,011.40, $1,995.35, and $1,976.50, while resistance levels are at $2,032.50, $2,045.20, and $2,064.90.

Insight:

The speculation around the Federal Reserve’s potential rate cut continues to be a driving factor in the market sentiment and the performance of the US Dollar. It is expected that traders will closely monitor economic indicators and Fed communications in the coming months to gauge the likelihood of a rate cut. Additionally, geopolitical tensions and global economic developments will also play a role in shaping the direction of XAU/USD as investors seek safe-haven assets amid uncertainty.