Following a slight increase on Friday, the gold price has taken a disappointing turn today. This shift raises questions about the authenticity of the recent movements.

With no significant developments in the news on either day, it is likely that the price fluctuations were driven by technical factors. In a previous analysis, it was highlighted that gold remained below the 61.8% Fibonacci retracement, indicating continuity in the medium-term downtrend for mining stocks. This foresight prepared readers for the current market behavior and allowed for anticipation of future moves.

Insightful Analysis of Gold Price Corrections

The correction in the gold price to the 61.8% Fibonacci retracement level is a common occurrence during price corrections. The significance lies in the consistent resistance observed at this level in multiple instances. Despite this, there have been no substantial changes from a technical standpoint. Hence, the current decline in gold price below the 50% retracement is deemed as a normal market correction.

Moreover, considering that 61.8% often marks the maximum correction size, there is a possibility that the peak in gold has already been reached.

Silver and Junior Miners’ Trends

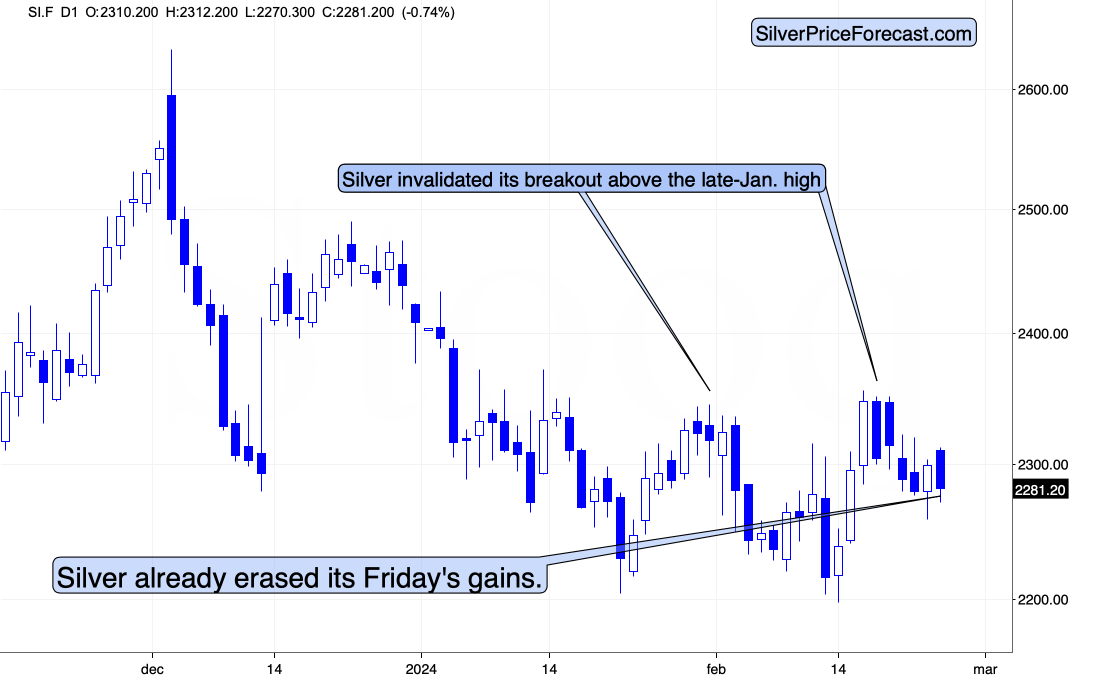

Silver retraced its Friday rally, mirroring the downward movement in junior mining stocks.

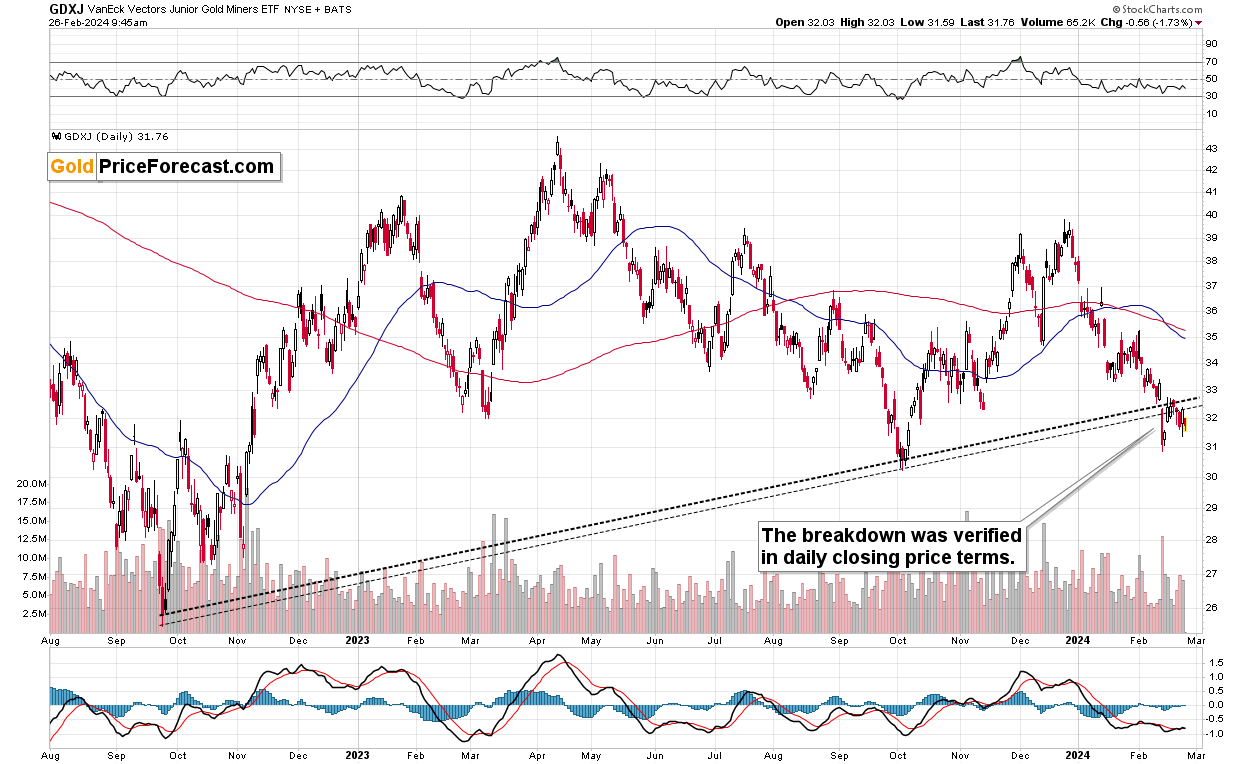

Analysis of recent trends indicates a validation of the breakdown below the rising support/resistance line based on the 2022 and 2023 lows. The underperformance of junior miners compared to gold signals a bearish outlook for both sectors. Despite potential external influences, such as corporate earnings impacting the S&P Index, the focus remains on the ongoing trends in junior mining stocks.

While the USD Index remains stable, a potential rally is on the horizon, emphasizing a negative impact on gold prices. The confirmed breakdown in junior miners further supports the notion of an impending market correction.

It is suggested that profit-take levels could be reached soon, indicating a possible conclusion to recent market movements.

For exclusive insights and updates beyond mainstream analysis, subscribe to our free newsletter today!

Additional insight: The analysis suggests that market movements in gold, silver, and junior mining stocks are influenced by technical factors and potential corrections in price levels. The comparison between gold price behavior and the USD Index indicates a possible negative correlation, signaling a downward trend in gold prices. Investors may consider adjusting their positions based on the anticipated market corrections and profit-take opportunities.