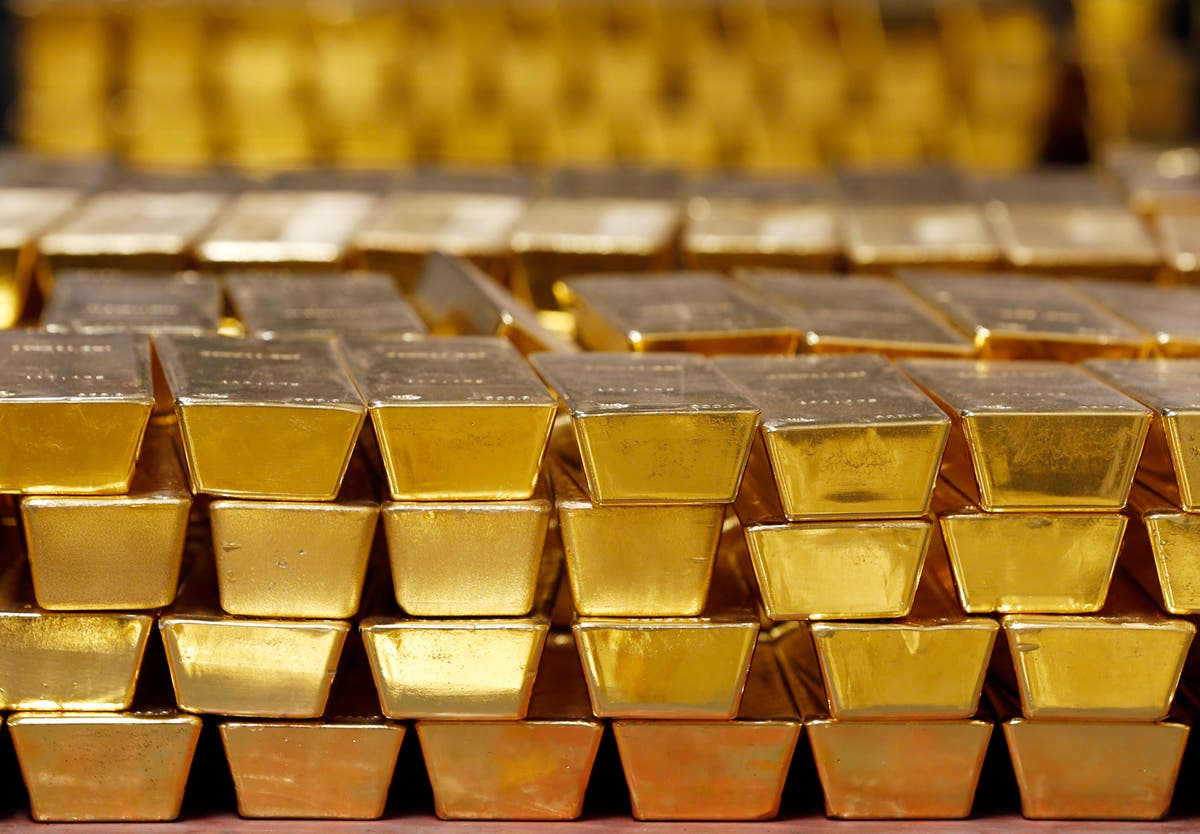

Gold

Gold price managed to reverse its recent losses, closing positively on Tuesday and halting a two-day decline. Despite this rebound, gold found itself caught within a tight trading range early Wednesday as market participants await further guidance on the Federal Reserve’s interest rate trajectory.

Gold Price Takes Influence of Fed’s Policy and Global Tensions

The prospect of sustained higher interest rates, bolstered by the resilience of the US economy, continues to challenge gold’s allure. However, the US dollar’s slight retreat from its three-month peak, coupled with easing US Treasury yields, provides a backdrop against which gold navigates.

Geopolitical strife and China’s economic slowdown also play pivotal roles, offering some support to the precious metal amidst these headwinds.

Anticipated Economic Indicators and Market Dynamics

While Wednesday’s trade balance data may not significantly sway market sentiment, remarks from key Federal Reserve officials and the direction of US bond yields will be closely monitored. These elements, along with the broader market sentiment, are expected to influence gold’s price action.

The recalibration of rate-cut expectations, in light of strong US economic indicators and Fed officials’ cautious stance on easing, introduces a complex landscape for gold investors.

Gold Price Forecast: Technical Outlook

As of February 7, GOLD XAU/USD is trading at $2,035, indicating a slight uptrend from its previous position. The pivot point now stands at $2,035, serving as a critical indicator for immediate price movements.

Resistance levels have been adjusted to $2,035, $2,045, and $2,070, presenting possible barriers to Gold’s ascent. On the flip side, support levels are identified at $2,025, $2,015, and $2,005, offering a safety net for potential downturns.

The Relative Strength Index (RSI) remains at a near-neutral 48, suggesting a balanced market dynamic without clear signs of overbought or oversold conditions. The 50-day Exponential Moving Average (EMA) aligns with the updated pivot point at $2,035, marking a crucial intersection for technical analysis.

Gold’s chart analysis indicates a pivotal moment for the precious metal, as it hovers around the updated support-turned-resistance level of $2,035. This zone is critical; a move above could signal bullish momentum for XAU/USD, while failure to surpass may reinforce bearish sentiments.

Given these developments, Gold’s market outlook is cautiously optimistic above the $2,035 mark.

Investors and traders will closely monitor the pivot point and EMA convergence for signs of future direction, with a keen eye on surpassing the resistance levels to confirm a positive trend.