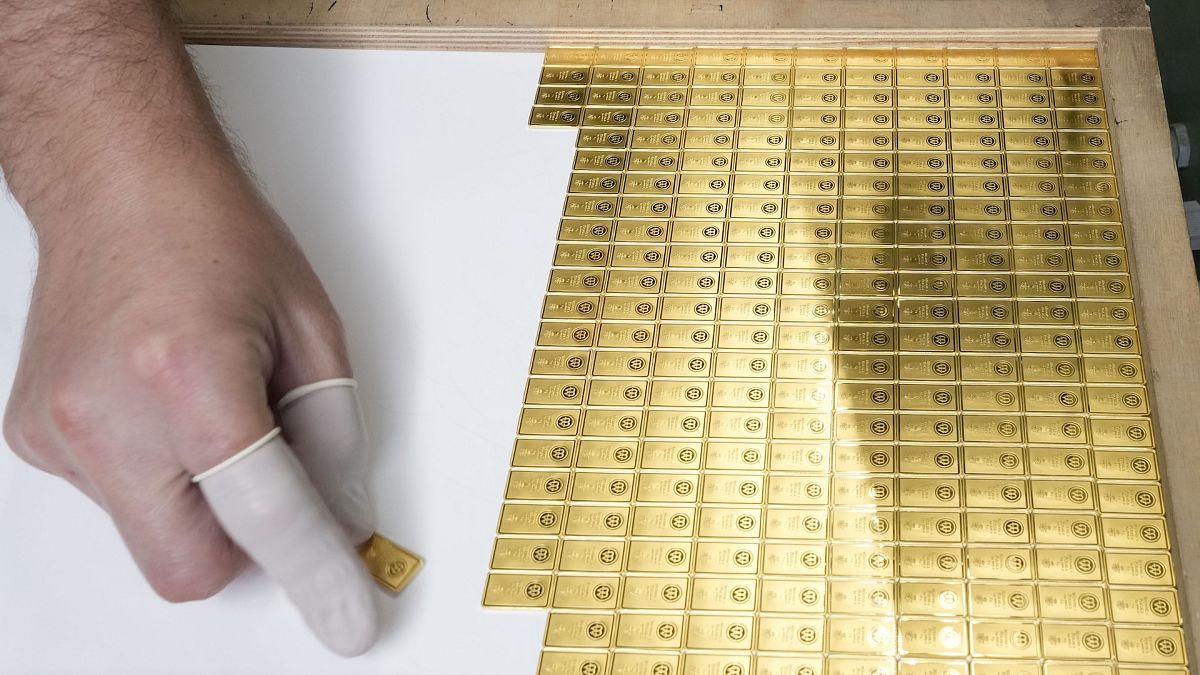

The price of gold reached a new all-time high for the 28th time this year on the back of increased market volatility, driving demand for the precious metal as a safe haven asset in times of uncertainty. The closing price for December gold futures stood at $2,546.80 per ounce, marking a 1.8% increase on the New York Mercantile Exchange. During the week, gold prices registered a 2.6% gain, climbing in four out of five trading days.

Market Analyst Peter Spina from GoldSeek.com highlighted the prevailing risks in the market that are prompting investors to turn to gold as a safe haven. He emphasized the various instability factors, ranging from geopolitical tensions to financial risks, that are driving the interest in gold as a hedge against uncertainty.

The Gold Market Amid Historic Times

Spina noted the historic nature of the current gold market, suggesting that these significant developments are not receiving ample attention, particularly in the West. This lack of focus may be attributed to the limited coverage of gold and silver in mainstream Western media outlets. Despite the substantial growth in these precious metals, the under-representation in traditional financial news channels could be leading investors to overlook valuable information regarding a potentially lucrative asset class.

Future Outlook and Potential Growth

Spina predicted that as the Federal Reserve moves to cut interest rates in the U.S., the price of gold could see a substantial increase from its current levels. As a non-interest-bearing asset, gold becomes more appealing to investors when interest rates decline. He suggested that all the conditions are in place for gold to surge to new record highs in the coming months, with $3,000 per ounce becoming an achievable target sooner than expected.

Looking ahead, Spina projected that gold prices could test the $3,000 mark by the end of the first quarter of 2025, based on the ongoing strong demand dynamics in the gold market. He emphasized that once mainstream financial media acknowledges the underlying bullish trend in gold, there could be a significant uptick in market activity, especially if institutional investors join the gold rush.

It is essential to note that the opinions presented in this article are for informational purposes only and should not be considered as financial advice. Investors are encouraged to assess their individual financial circumstances, investment objectives, and risk tolerance before making any decisions. Seeking advice from a qualified financial advisor is recommended to ensure informed investment choices.

Source: marketwatch