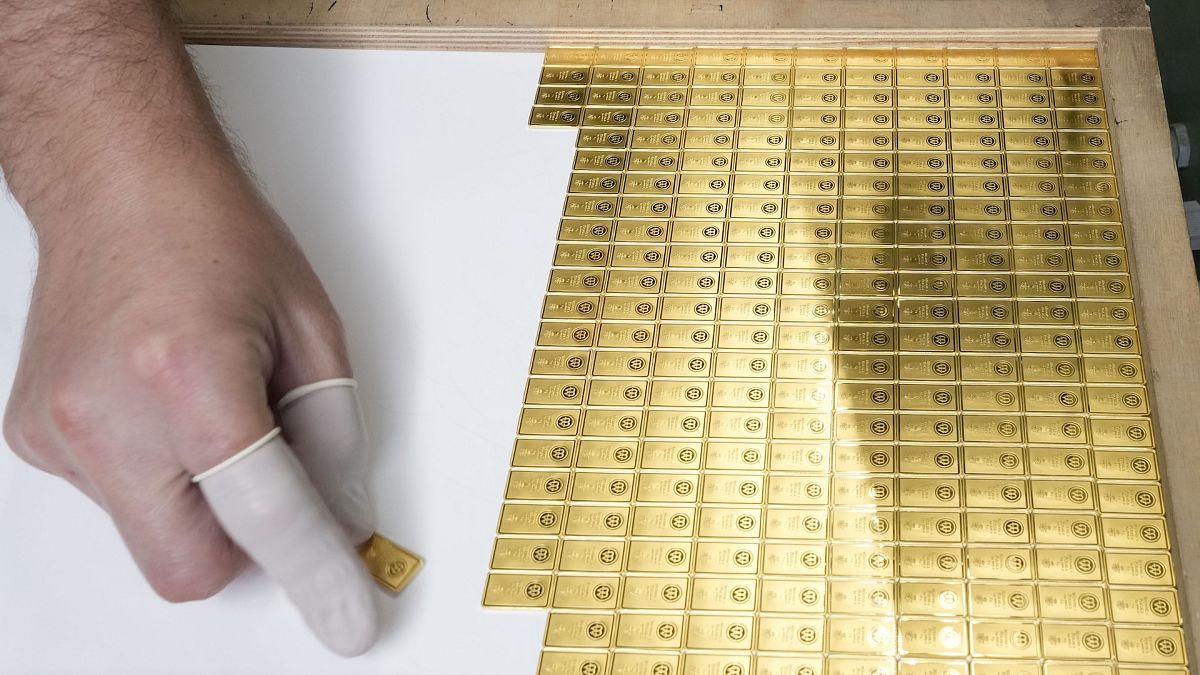

Gold Prices Soar to Record High

Gold prices have recently soared to a new all-time high, propelled by expectations of a lower interest rate environment and a growing demand for safe-haven assets. Investors are turning to gold as a hedge against economic uncertainty and market volatility.

Weakened Base Metals

In contrast to gold’s upward trajectory, base metals like copper have struggled to gain momentum. This can be attributed to the sluggish economic growth experienced in major economies, with China being a significant contributor to the decline in base metal prices. The ongoing trade tensions between the U.S. and China have also put pressure on industrial metals, impacting their demand and pricing.

Market Sentiment and Economic Indicators

Gold’s surge to record levels reflects the overall market sentiment, which is cautious and risk-averse. The uncertainty surrounding global trade, geopolitical tensions, and the economic impact of the COVID-19 pandemic have all contributed to the preference for safe-haven assets like gold.

Additionally, the expectation of central banks worldwide to maintain accommodative monetary policies and lower interest rates has further bolstered the appeal of gold as an investment option. With the prospect of inflation looming, investors are flocking to assets like gold to protect their wealth.